Bitcoin

Savvy Bitcoin investors have been tracking the growth of their holdings over the past decade. But the growth in the value of the coin isn’t the story that has caught their attention the most. Security plays a big part in cryptocurrency investing.

As a security expert, Jameson Lopp, co-founder of Casa, a Bitcoin storage company, has put together a set of rules to help investors keep their Bitcoins safe. These rules are for individuals with hundreds to thousands of dollars in Bitcoin, not for the crowd that has millions of dollars invested in the currency.

Don’t leave Bitcoin on exchanges

Bitcoin is a storable asset, like precious metals or collectibles. Instead of touching it like gold, it uses a private key — a complex form of cryptography designed to give access to the rightful owner of the Bitcoin. If anyone has the key, they can spend that Bitcoin at any time.

Most people buy Bitcoin from exchanges. This is convenient because you just leave them there, like putting money in a wallet. But in return, the exchange holds the private keys, which exposes the owner’s assets to risk and many external threats. The exchange could be hacked, taken over, or for any number of reasons, left without a single Bitcoin.

These threats may sound theoretical, but they have been a recurring theme throughout Bitcoin’s history. In 2014, the MTGOX exchange announced that 850,000 Bitcoins were missing and possibly stolen. The exchange filed for bankruptcy, leading to a legal mess that continues to this day. MTGOX handled the majority of Bitcoin transactions at the time, and early investors remember how they lost their money for no reason.

But this is not an isolated case. Since 2014, Jameson Lopp’s company has seen dozens of other exchanges suffer serious damage from both internal and external attacks.

Don’t Take Unnecessary Risks

There’s a saying in American finance: You only get rich once. As investors accumulate significant, life-changing wealth, their risk tolerance changes and they tend to shift their mindset from accumulation to preservation. This is especially true for investors with significant Bitcoin holdings. Trading or lending puts an investor’s Bitcoin at risk, and the rewards aren’t always worth the risk.

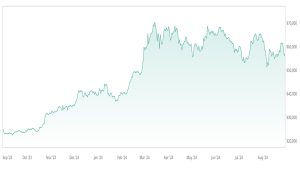

With today’s price surge, it’s becoming increasingly difficult to buy back lost Bitcoin. If investors are bullish on Bitcoin as a store of wealth or even an inflation hedge, they can only expect to reap those rewards if they hold onto their money. Anything else is risky.

Consider all the threats

Humans have cognitive biases, and these biases sometimes cause us to worry too much about one threat and ignore other threats that may occur. Bitcoin is a digital currency, and investors are hyper-aware of the risk of having their personal devices hacked. That risk may make them want to keep their funds on an exchange, which is more or less protected by security experts. However, these exchanges are still vulnerable to attacks because they hold many people’s funds.

In fact, Bitcoin investors are more likely to lose their money through their own mistakes than through external factors. It is difficult to steal a wallet, but easy to misplace it. The same goes for digital currencies. These threats can be mitigated by contingency planning, backups, and even inheritance.

Big investors are often so afraid of making mistakes that they move their funds to vault services that store their private keys in underground tunnels, literally. But by doing so, they are not really protecting themselves from all threats, they are simply transferring the risk to someone else to manage.

If a significant amount of an investor’s assets are in Bitcoin, they want to be protected from all threats they can see and the unforeseen. To do so, they need to consider security and contingency plans from every angle, including their own mismanagement.